Continuity

We are entrepreneurs – not financial buyers, nor a large corporation. Our priorities are fully aligned with yours: Your brand will be preserved, your employees will be secure, and we will pursue growth and value additive strategies in order to continue to build the business and brand.

Expertise

Our advisors and investors share our passion for growing small to mid-sized companies. Together we have the knowledge, dedication, and experience to see your business through its next phase of growth, with expertise across a wide range of industries including aerospace, education, environmental services, healthcare, insurance, logistics, manufacturing, real estate, and technology. Your business is in good hands.

Growth

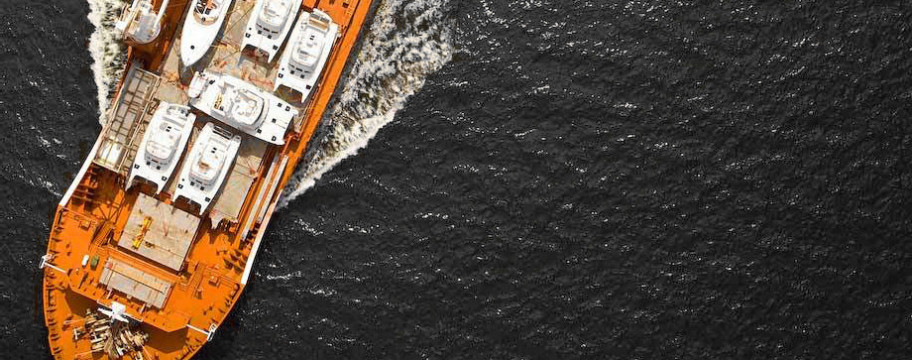

As entrepreneurs, we prioritize growth. This can be in contrast to traditional private equity funds and strategic acquirers, who often overemphasize financial engineering and cost cutting – measures which may lead your business into troubled waters.

Integrity

Reputation is our most valued asset, and our decisions are driven by a long term outlook. You can be assured of honest and candid communications and high ethical standards in all of our interactions.

Tribula Advantage

| Tribula Group | Private Equity Funds | Strategic Buyers | |

|---|---|---|---|

| Value Creation / Goals | Build and grow revenues, and implement growth oriented operational improvements. | Maximize returns through financial engineering (leverage) and cost cutting. | Cost cutting and synergies through asset integration. Redundant divisions may be shut down. |

| Investment Horizon | Long term (with flexibility towards investor liquidity). | Exit in 3-5 years. | Variable; The acquired company and brand may even be dissolved into the parent. |

| Commitment Level | Tribula Group’s management is dedicated to a small number of investments, and as entrepreneurs we bring operating resources and an experienced board to our companies. | One of many portfolio companies; involvement primarily at the board level. | One of many business units/divisions; additional bureaucracy and decision making hurdles from managers not related to the company. |

| Transaction Structure & Timing | Ability to focus and move quickly. Flexible terms focusing on the needs of the seller. | Terms impacted by leverage and fund structure, with closing dependent on resources allocated across multiple deals. | Terms structured to protect the acquiring corporation, with approvals required from multiple committees and possibly the board. |